ASEAN ROAD FREIGHT TRANSPORT MARKET - GROWTH, TRENDS AND FORECASTS (2023-2028)

Download Free Sample

Industry Definition

The ASEAN road freight transport market focuses on the region’s trucking industry. Road freight is the movement of commodities by motor vehicles via a network of roads from one site to another (a place of loading and a place of unloading). The report also covers the economic overview of the country along with the market segmented by end users, distance, truckload, destination, temperature and countries.

Key Figures

Total Number of Companies in ASEAN: 795,497

Number of Companies in Transportation and Warehousing Sector in ASEAN: 38,399

Market Size of the ASEAN Road Freight Transport Market: USD xx billion (2021)

Inquire before buying!

Download Free Sample

Brief on the ASEAN Road Freight Transport Market

The ASEAN Road Freight Transport Market is estimated to grow with a compounded annual growth rate of about xx% during the forecast period of 2023-2028.

- Economic data suggest that trade across Asia will grow in the upcoming years as demand is boosted by post-Covid-19 recovery. The demand for contract logistics, forwarding, haulage, and the parcel supply chain will be directly impacted by this.

- In the months and years to come, new trade agreements and favourable rules are expected to promote intra-Asian trade in a number of ways. The easing of company regulations and the lowering of trade barriers will promote commerce and economic growth. Since most of Asia is connected by land, many clients find trucking services to be an affordable and effective option.

- Due to consumer expenditure on e-commerce and the need for door-to-door logistics services, cross-border trucking in Southeast Asia and from ASEAN to other regions of Asia is still increasing. Now accounting for about one-third of ASEAN’s logistics market, road freight is predicted to increase faster than other regions’ use of trucking logistics services over the next ten years.

- For DHL, one of the biggest logistics firms in the world, the expansion of the local e-commerce market has driven up demand for cross-border shipping. As manufacturing recovers and businesses regionalize and diversify their supply chains, the economic growth in many of Southeast Asia’s top economies has resumed, fueling the anticipated recovery. Similar predictions are made for Malaysia, where this year’s market is anticipated to have a 6% little economic resurgence.

ASEAN Turning into a Logistics Hub

- ASEAN has developed into a global centre for manufacturing over the past 20 years because to consistently rising investment flows and GDP development. The main factors driving foreign companies to further expand their production into ASEAN today are rising labour costs, supply chain issues, and geopolitical tensions, with Singapore, Indonesia, Thailand and Vietnam leading as key prospects in the region.

- Manufacturing clusters that are well-established already exist in the region. This includes semiconductors, biopharmaceuticals, and aerospace components in Singapore; electronics in Malaysia and Vietnam; vehicles and packaged foods in Thailand; machinery and petrochemicals in Indonesia; packaged foods and garments in the Philippines. Manufacturers looking for cheap labor have long looked to Southeast Asia’s growing countries, while Singapore has historically been a centre for high-value R&D-intensive businesses and trade-supporting services like finance and logistics.

- Since it combines low prices, specialized skills, and largely unrestricted access to both Western and Asian markets, Southeast Asia is an excellent choice for new industrial locations. The ASEAN economies of Indonesia, Malaysia, the Philippines, and Thailand are among of the most cost-competitive in the world when it comes to pay rates that have been adjusted for productivity. Ecosystems are also developing to serve sectors of the economy other than those seeking labor arbitrage. For instance, Samsung listed a number of factors for choosing Vietnam as a new manufacturing hub in the area, including the country’s young, educated workforce, extensive internet access, domestic venture capital ecosystem, and government incentives and support.

- The ASEAN’s participation in extra-regional trade agreements has enhanced its reputation as a centre of global industry. For instance, the ASEAN Economic Community (AEC) sees ASEAN as an unified market and industry hub. Meanwhile, large-scale trade agreements like the Regional Comprehensive Economic Partnership (RCEP) are steps towards a more comprehensive Free Trade Area of the Asia-Pacific (FTAAP), which act as a valuable intergovernmental forum on free trade.

Competitive Landscape

- The ASEAN Road Freight Transport Market is fragmented, having a mix of significant global and domestic businesses. With a significant number of local players and several major players, the countries in the region are exploring their expanding capabilities with the developing trade relations and tech trends.

- In order to expand their geographic reach, service offerings, and product portfolios, the companies in the market strive to grow both organically and inorganically.

- The companies are facing immense competition in terms of technological adaptability, delivery price and delivery time.

- Industry sources claim that Deutsche Post DHL Group occupies a key position in the ASEAN Road Freight Transport market accompanied with Kerry Logistics Network Limited, MOL Logistics, Yamato Transport, and Expeditors International among others.

Why buy this report on ASEAN Road Freight Transport Market

UPKR Intelligence market research reports enable you to:

- Understand the market

- Pinpoint the key industry trends

- Identify threats and opportunities

- Quickly build competitive intelligence

This report on ASEAN Road Freight Transport Market:

- Provides the data on economic status of ASEAN region, trade relations, modal engagement and market size information to assist with planning and strategic decisions.

- It helps you understand market dynamics to give you a deeper understanding of industry competition and the supply chain.

- Analyses key performance and operational metrics so that you can benchmark against your own business, that of your customers’ businesses, or your competitors’ businesses.

The ASEAN Road Freight Transport Market research report includes:

- Analysis of the important factors influencing this industry’s history, including data

- Five-year market projection and trends identified

- For the primary products and markets, thorough research and segmentation

- Analysis of key players in the market, their shares and the competitive environment

UPKR Intelligence is a market research company fully concentrated on the logistics domain. We cover the entire market including the dynamic trends, various segments and the market competition via the analysis of the companies operating in the market to arrive at conclusions to aid the needs of our clients.

Table Of Content

- Market Overview

- Economic Overview of the ASEAN

- Overview on ASEAN Road Freight Transport Market

- Inter-modal Share of Freight Transportation in ASEAN

- Market Dynamics

- Market Drivers

- Restraints

- Value Chain Analysis

- Porter’s Five Forces Analysis

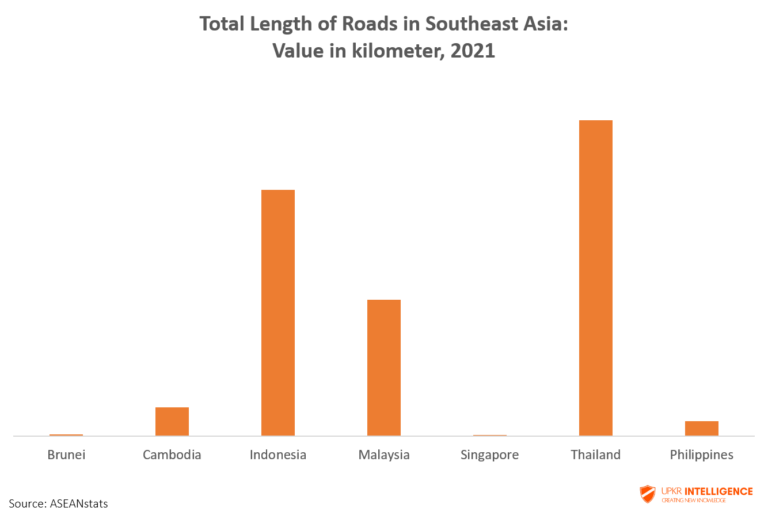

- Spotlight on Infrastructural Development in ASEAN (Covers Investment on Infrastructure, Length of Roads Paved and Unpaved)

- Government Regulations and Initiatives

- Spotlight on Trade Activities in ASEAN

- Insights on Factors Affecting the Freight Rates

- Spotlight on Containerization in ASEAN Transportation Sector

- Market Segmentation for ASEAN Road Freight Transport Market

- By End-Users

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Mining

- Trade (Wholesale and Retail)

- Others

- By Destination

- Domestic

- International

- By Truckload

- Full Truckload (FTL)

- Less Than Truckload (LTL)

- By Distance

- Long Haul

- Short Haul

- By Temperature

- Controlled

- Non-Controlled

- By Country

- Singapore

- Thailand

- Indonesia

- Rest of ASEAN

- By End-Users

- Competitive Landscape

- Market Concentration Overview of ASEAN Road Freight Transport Market

- Company Profiles (list not exhaustive)

- Outlook and Opportunities in the ASEAN Road Freight Transport Market

- Appendix

- GDP Distribution and Growth by Economic Activities

- Inflation Statistics

- Contribution of the Transport and Storage Sector to GDP

Related Reports

- ASEAN Multimodal Freight Transport Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Air Freight Transport Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Rail Freight Transport Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Sea Freight Transport Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Third-Party Logistics (3PL) Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Fourth-Party Logistics (4PL) Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Same Day Delivery Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Express Delivery Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Last Mile Delivery Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN CEP Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Warehousing and Distribution Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Automotive Logistics Market – Growth, Trends and Forecasts (2023-2028)

- ASEAN Freight and Logistics Market – Growth, Trends and Forecasts (2023-2028)